File Name: Valuation – Firm in Financial Distress

Location: Modeling Toolkit | Valuation | Firm in Financial Distress

Brief Description: Illustrates how to value the continued operations of a firm under distress, as well as to ascertain its creditworthiness

Requirements: Modeling Toolkit, Risk Simulator

Special Credits: This model was contributed by Prof. Morton Glantz.

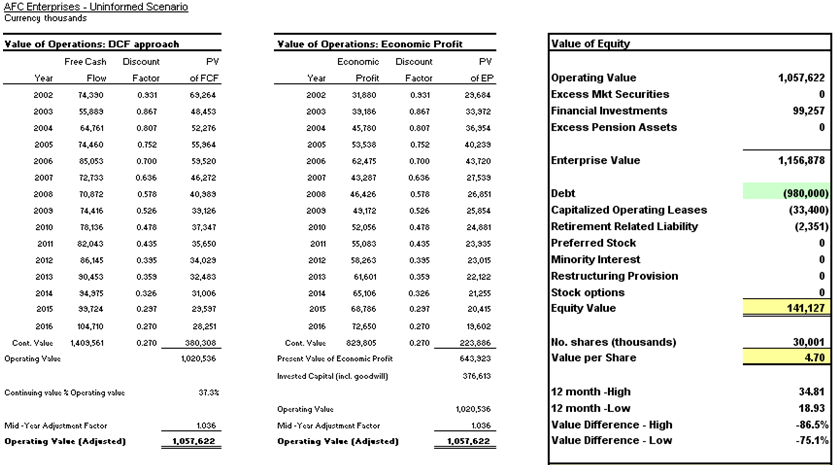

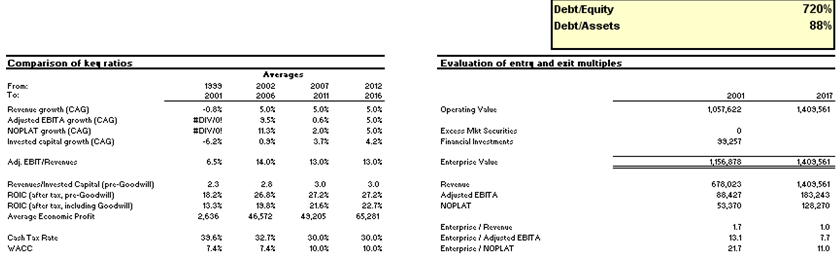

In this model, the publicly available McKinsey discounted cash flow (DCF) model is employed to value the probability that the equity value of a company falls below zero. (This is set as an output forecast variable in a simulation.) A sample snapshot of the model is shown in Figure 153.1.

When equity values fall below zero, the firm has an excess of economic liabilities above and beyond its economic assets. (The assets are underwater.) Using this approach, bankers, under the Basel II/III requirements, can internally access the expected default frequency (EDF) or obligor risk, using their own assumptions and projections of the company’s financial health. Finally, positive economic equity implies a call option whereby the shareholders can purchase the assets from creditors by paying off all the loans and continue business well past the residual period. A negative economic equity implies a put option whereby shareholders put or sell the assets to the creditors and can walk away from the bankrupt business exactly as if they purchased an out-of-the-money option and walked away losing only their initial investment.

Figure 153.1: Firm in financial distress