File Name: Exotic Options – Asian Arithmetic

Location: Modeling Toolkit | Exotic Options | Asian Arithmetic

Brief Description: Solves an Asian lookback option using closed-form models, where the lookback is linked to the arithmetic average of past prices

Requirements: Modeling Toolkit

Modeling Toolkit Functions Used: MTAsianCallwithArithmeticAverageRate, MTAsianPutwithArithmeticAverageRate

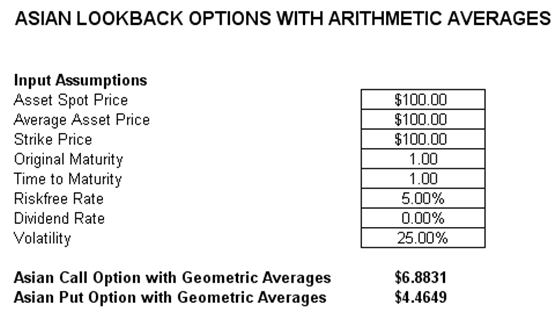

Asian options (also called Average Options) are options whose payoffs are linked to the average value of the underlying asset on a specific set of dates during the life of the option. An average rate option is a cash-settled option whose payoff is based on the difference between the average value of the underlying during the life of the option and a fixed strike. The Arithmetic version means that the prices are simple averages rather than geometric averages (Figure 35.1).

End-users of currency, commodities, or energy trading tend to be exposed to average prices over time, so Asian options are attractive for them. Asian options are also popular with corporations and banks with ongoing currency exposures. These options are also attractive because they tend to be less expensive—sell at lower premiums—than comparable vanilla puts or calls. This is because the volatility in the average value of an underlying asset or stock tends to be lower than the volatility of the actual values of the underlying asset or stock. Also, in situations where the underlying asset is thinly traded or there is the potential for its price to be manipulated, an Asian option offers some protection. It is more difficult to manipulate the average value of an underlying asset over an extended period of time than it is to manipulate it just at the expiration of an option.

Figure 35.1: Computing the Asian lookback option (arithmetic mean)