File Name: Credit Analysis – Profit Cost Analysis of New Credit

Location: Modeling Toolkit | Credit Analysis | Profit Cost Analysis of New Credit

Brief Description: Analyzes the cost and profit from a potential credit issue based on the possibilities of nonpayment by the debt holder

Requirements: Modeling Toolkit, Risk Simulator

Modeling Toolkit Functions Used: MTCreditAcceptanceCost, MTCreditRejectionCost

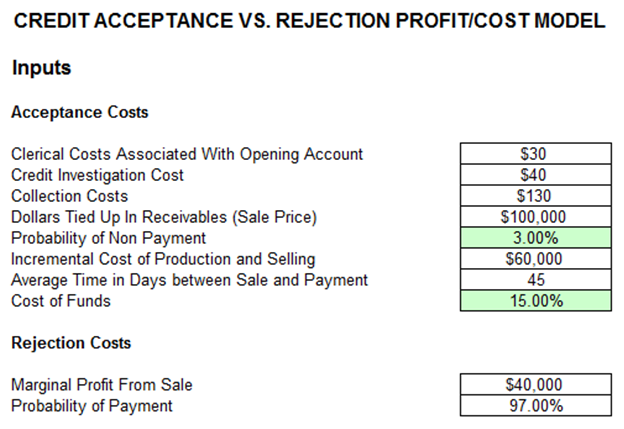

This model is used to decide if new credit should be granted to a new applicant based on the requisite costs of opening the new account, as well as other incremental costs. In addition, using the cost of funds and average time to receive payments as well as the probability of nonpayment or default (use the various probability of default models in the Modeling Toolkit, explained in later chapters, to determine this), we can then determine the cost of accepting and the cost of rejecting this new line of credit and the probability of breakeven. By using this model, a bank or credit-issuing firm can decide if it is more profitable to accept or reject the application, as well as compute the probability of breakeven on this line of credit (Figure 15.1).

Figure 15.1: Credit acceptance and rejection profit and cost model