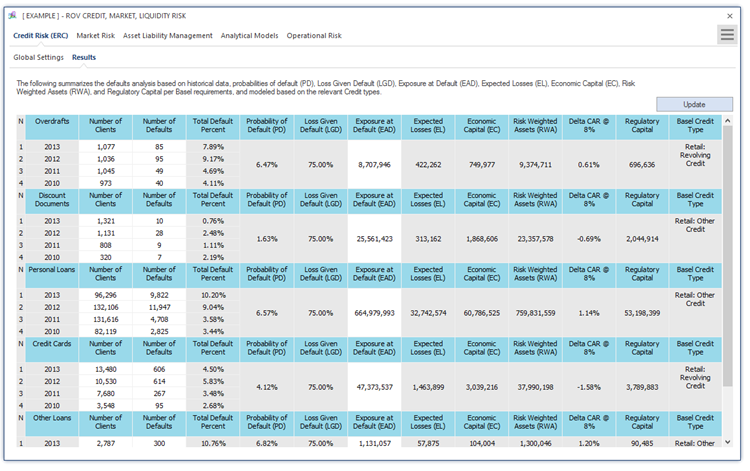

Figure 1.2 illustrates the PEAT utility’s ALM-CMOL module for Credit Risk—Economic Regulatory Capital’s Results tab. The results are shown in the grid if data files were loaded and preprocessed, and results were computed and presented here (the loading of data files is discussed in connection with Figure 1.1). However, if data are to be manually entered (as previously presented in Figure 1.1), then the grey areas in the data grid are available for manual user input, such as the number of clients for a specific credit or debt category, the number of defaults for said categories historically by period, and the exposure at default values (total amount of debt issued within the total period). One can manually input the number of clients and of credit and loan defaults within specific annual time-period bands. The utility computes the percentage of defaults (the number of credit or loan defaults divided by the number of clients within the specified time periods), and the average percentage of default is the proxy used for the PD. If users have specific PD rates to use, they can simply enter any number of clients and number of defaults as long as the ratio is what the user wants as the PD input (e.g., a 1% PD means users can enter 100 clients and 1 as the number of defaults). The LGD can be user inputted in the global settings as a percentage (LGD is defined as the percentage of losses of loans and debt that cannot be recovered when they are in default). The EAD is the total loans amount within these time bands. These PD, LGD, and EAD values can also be computed using structural models as is discussed later. Expected Losses (EL) is the product of PD × LGD × EAD. Economic Capital (EC) is based on Basel III/IV and Basel III/IV requirements and is a matter of public record. Risk Weighted Average (RWA) is a regulatory requirement per Basel III/IV and Basel III/IV such as 12.5 × EC. The change in Capital Adequacy Requirement (ΔCAR @ 8%) is simply the ratio of the EC to EAD less the 8% holding requirement. In other words, the Regulatory Capital (RC) is 8% of EAD.

The results obtained by the model allow for the construction of key risk indicators, comparing basic regulatory capital requirements with these economic capital requirements. Additionally, when coupled with the internal or external rating models (or credit scores), a profile of expected and unexpected losses for each product or asset type can be constructed. This is also the basis for the application of RAROC indicators, and the effective allocation of economic capital, in line with the international standards and local regulatory requirements.

Figure 1.2: Economic Regulatory Capital (ERC)