File Name: Exotic Options – Currency Options

Location: Modeling Toolkit | Exotic Options | Currency Options

Brief Description: Values a foreign exchange currency option, typically used in hedging foreign exchange fluctuations, where the key inputs are the spot exchange rate and the contractual purchase or sale price of the foreign exchange currency for delivery in the future

Requirements: Modeling Toolkit

Modeling Toolkit Functions Used: MTCurrencyCallOption, MTCurrencyPutOption

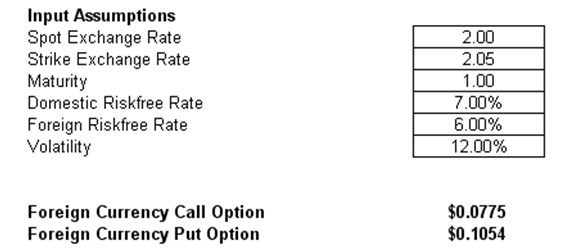

A Foreign Exchange Option (FX Option or FXO) is a derivative where the owner has the right but not the obligation to exchange money denominated in one currency into another currency at a previously agreed-upon exchange rate on a specified date. The FX Options market is the deepest, largest, and most liquid market for options of any kind in the world. The sample valuation here (Figure 44.1) uses the Garman-Kohlhagen model.

Figure 44.1: Computing the foreign exchange option

As an example, suppose the British pounds (GBP) versus the U.S. dollar (USD) is USD2/GBP1, then the spot exchange rate is 2.0, and because the exchange rate is denominated in GBP (the denominator), then the domestic risk-free rate is the rate in the United Kingdom, and the foreign rate is the rate in the United States. This means that the foreign exchange contract allows the holder the option to call GBP and put USD.

To illustrate, suppose a U.K. firm is getting US$1M in six months, and the spot exchange rate is USD2/GBP1. If the GBP strengthens, the U.K. firm loses if it has to repatriate USD back to GBP; it gains if the GBP currency weakens. If the firm hedges the foreign exchange exposure with an FXO and gets a call on GBP (put on USD), it hedges itself from any foreign exchange fluctuation risks. For discussion purposes, say the timing is short, interest rates are low, and volatility is low. Getting a call option with a strike of 1.90 yields a call value of approximately 0.10 (i.e., the firm can execute the option and gain the difference of 2.00 – 1.90, or 0.10, immediately). This means that the rate now becomes USD1.90/GBP1, and it is cheaper to purchase GBP with the same USD, or the U.K. firm gets a higher GBP payoff.