File Name: Yield Curve – Spline Interpolation and Extrapolation

Location: Modeling Toolkit | Yield Curve | Spline Interpolation and Extrapolation

Brief Description: This is the multidimensional cubic spline model for estimating and modeling the term structure of interest rates and yield curve approximation using a curve interpolation and extrapolation methods

Requirements: Modeling Toolkit, Risk Simulator

Modeling Toolkit Function Used: MTCubicSpline

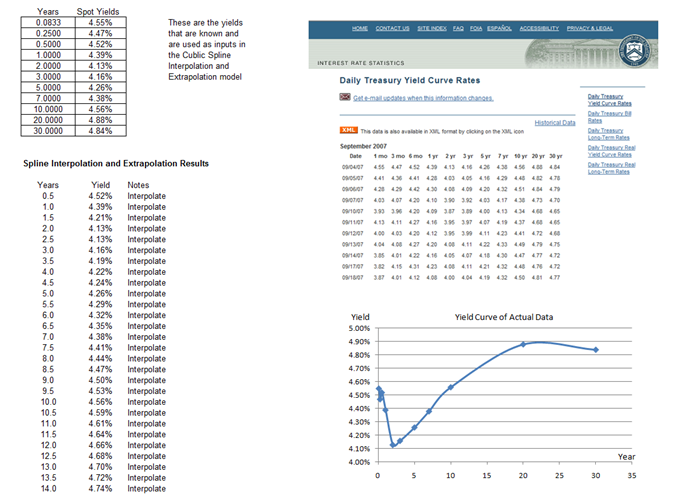

The cubic spline polynomial interpolation and extrapolation model is used to “fill in the gaps” of missing spot yields and term structure of interest rates whereby the model can be used to both interpolate missing data points within a time series of interest rates (as well as other macroeconomic variables such as inflation rates and commodity prices or market returns) and also used to extrapolate outside of the given or known range, useful for forecasting purposes. In Figure 2.33, the actual U.S. Treasury risk-free rates are shown and entered into the model as known values. The timing of these spot yields is entered as Years (the known X value inputs), whereas the known risk-free rates are the known Y values. Using the MTCubicSpline function, we can now interpolate the in-between risk-free rates that are missing as well as the rates outside of the given input dates. For instance, the risk-free Treasury rates given include 1-month, 3-month, 6-month, 1-year, and so forth, until the 30-year rate. Using these data, we can interpolate the rates for, say, 5 months or 9 months, and so forth, as well as extrapolate beyond the 30-year rate.

Figure 2.33: Cubic Spline Model