File Name: Exotic Options – Inverse Gamma Out-of-the-money Options

Location: Modeling Toolkit | Exotic Options | Inverse Gamma Out-of-the-money Options

Brief Description: Analyzes options using an inverse gamma distribution rather than the typical normal-lognormal assumptions; this type of analysis is important for valuing extreme in- or out-of-the-money options

Requirements: Modeling Toolkit

Modeling Toolkit Functions Used: MTInverseGammaCallOption, MTInverseGammaPutOption

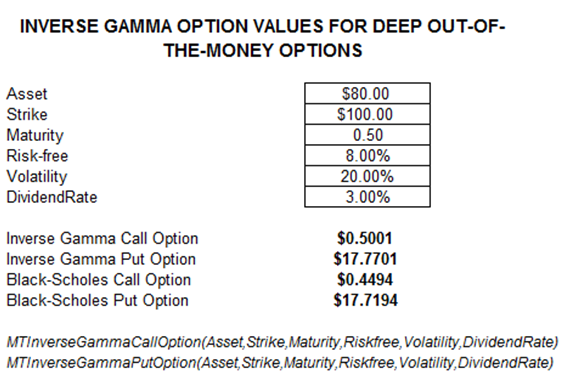

This model computes the value of European call and put options using an Inverse Gamma distribution, as opposed to the standard normal distribution (Figure 58.1). This distribution accounts for the peaked distributions of asset returns and provides better estimates for deep out-of-the-money options. The traditional Generalized Black-Scholes-Merton model is also provided as a benchmark.

Figure 58.1: Inverse gamma options